Defeating the Discombobulating Dialectic: Or, Just Trade the Damn Thing! Part II.

The practitioner of tomorrow has already dissolved artificial boundaries.

Read Part I Here:

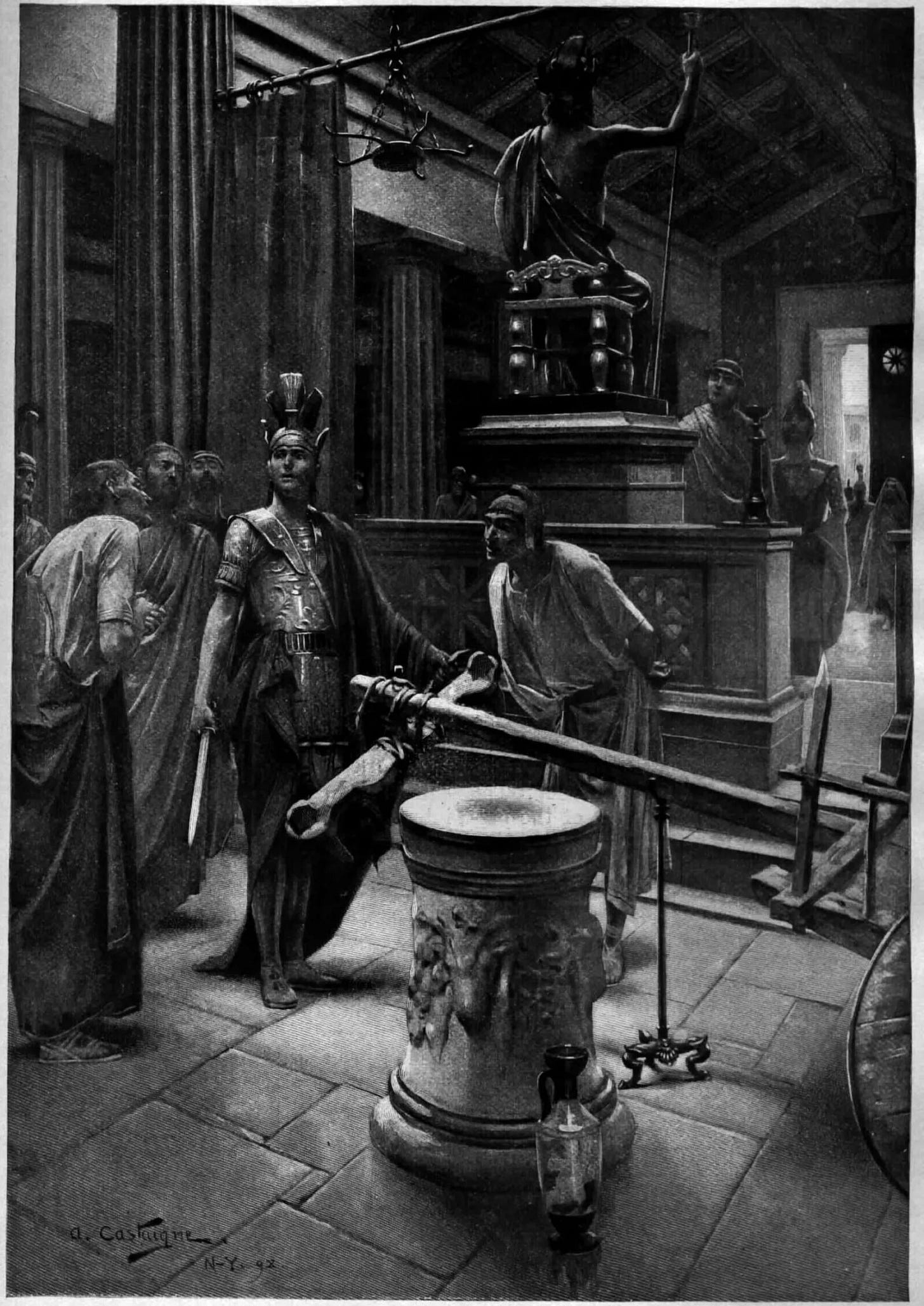

At the AXIA trading desks.

Tuesday 19th November 2024,

London, England.

“Then Spoos put in a new high. Maybe fading geopolitical risk isn’t the worst idea in the world,” said this trader. “But I’m not so confident in fading nuclear war just yet.” Fading nuclear war? Win-win all round! You retire or get retired. Ah! Good old perverse incentives—the Fed Put was so last decade…

And now I’m speaking with another young buck at his desk on AXIA’s London floor, who netted shy of six-figures on yesterday’s events; another perspective on Tuesday 19 November. Pan left, and you spot the usual assortment of a dozen monitors, containing X feeds, news terminals; yet the rest of the screens are absolutely pasted with price ladders—everywhere! And unlike the Cypriot’s comparatively sleek machine, these ladders are all different shapes, sizes, and co…